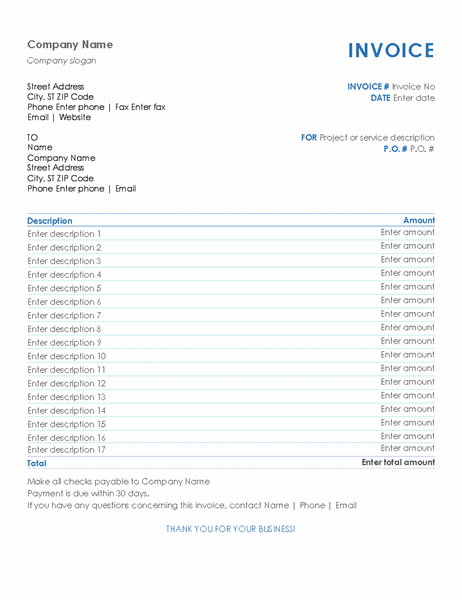

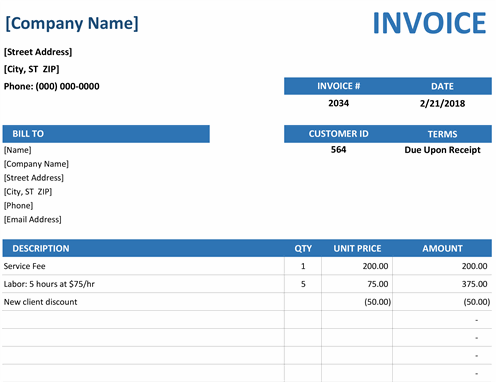

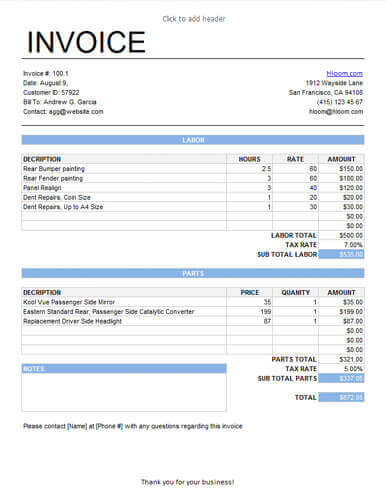

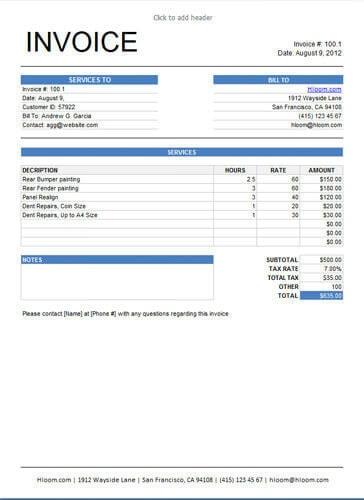

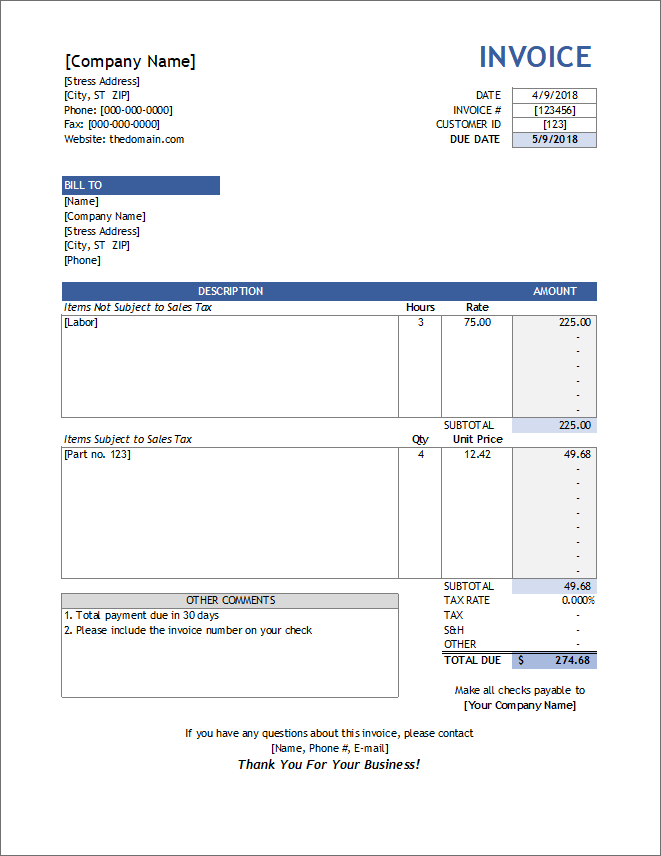

Services Invoice Format

These templates were in excel. All you need to do is download the edited invoice format and share it with your.

Service Invoice Templates For Excel

In any business that provides products and services to clients an invoice is essential in the transaction.

. To make your work easy and use this invoice as a template for future invoices you can use formulas. How Many Types of Invoice in GSTThere will be 2 types of Invoices in GSTTax InvoiceIt is to be used for all types of taxable SalesBill of SupplyIt is to be used for exempt sales Sales byComposition DealerNote-For both Goods and Services It will be Same Series bill bookAlso for both local and. An invoice bill or tab is a commercial document issued by a seller to a buyer relating to a sale transaction and indicating the products quantities and agreed-upon prices for products or services the seller had provided the buyer.

Payment terms are usually stated on the invoice. Businesses will need to ensure that the GST transaction invoices are passed with. Browse the categories to find templates designed for sales companies service companies consultants freelancers sole traders limited companies contractors and small business owners.

This can be useful for following up with them later. A tax invoice is a piece of primary evidence for the customer to claim an input tax credit for products and services. The Invoice Simple invoice generator allows you to email your invoice download a PDF copy or send a link to your invoice.

Tax invoice broadly accommodates details like description of products and services purchased with applicable tax and other particulars as prescribed in the Tax invoice. It is important to include the services provided cost of services client name client address your business contact information the terms of payment issue date and payment due. Most businesses that deal under GST already know the invoice format requirements but some questions arise when they do business with foreign clients with the place of supply outside of India.

Name Account Number and IFSC code. That is supplying goods and services to a recipient outside India in a foreign currency. The purpose of an invoice is to provide a person or a company who is the buyer and has purchased productsservices with written proof of payment.

These may specify that the buyer has a maximum number of days to pay and is sometimes. All you need to do is select the one that suits your needs best and download it in the format that you prefer. Time Limit of issuing the GST Invoice.

With GST around the corner it is extremely critical for businesses to start invoicing under GST mode and not face any roadblocks as they usher in the new age. The GST portal initially released two types of e-invoice templates. Whether it is a printed or digital invoice it serves as an important document for verification of legal sales.

One template was only with mandatory fields and the other was with both mandatory and optional fields. The major difference is the Services Accounting Code SAC code to mentioned instead of the Harmonised System of Nomenclature Code HSN Code. Each template comes with an editable Excel spreadsheet workbook template and a PDF invoice generated with the template.

Then generate a unique invoice number to include so that you can easily track the invoice. 50 Invoice Samples Format Examples 2022. For instance use the product formula if you have multiple SKUs and their prices.

However there are certain additional details that. An export invoice is nothing but an invoice created by an exporter for exporting goods and services. Applicable GST tax and Total Amount in the end.

Here is a sample e-invoice as generated by the ERP software. It has other details like the date of purchase penalities if any etc. If you email your Invoice directly from Invoice Simple well notify you when your customer views it.

Many templates for export invoices can be found online but most of them miss some critical GST requirements and business owner have a hard time with them when it comes to. Payment Terms and expected date for payment. Then add goods or services details section that includes goods service details price per SKU quantity discount if any tax applicable if any.

GST Invoice format for service providers is almost similar to the GST Invoice format issued for goods suppliers. With all the details filled into a GST invoice format PDF youre good to go. The tax invoice format in Excel generates an invoice for a taxable supply of products services.

Description Quantity Cost and Amount due. The export invoice in its format as well as particulars is same as the normal tax invoice under GST. GSTNs Initial Proposed format of e-Invoice.

Sample View of e-Invoice Format. It is a confirmation of payment and proof that the buyer bought certain goodsservices. If you send a link to your customer they can download or print the invoice from the link.

Copies of the GST Invoice required.

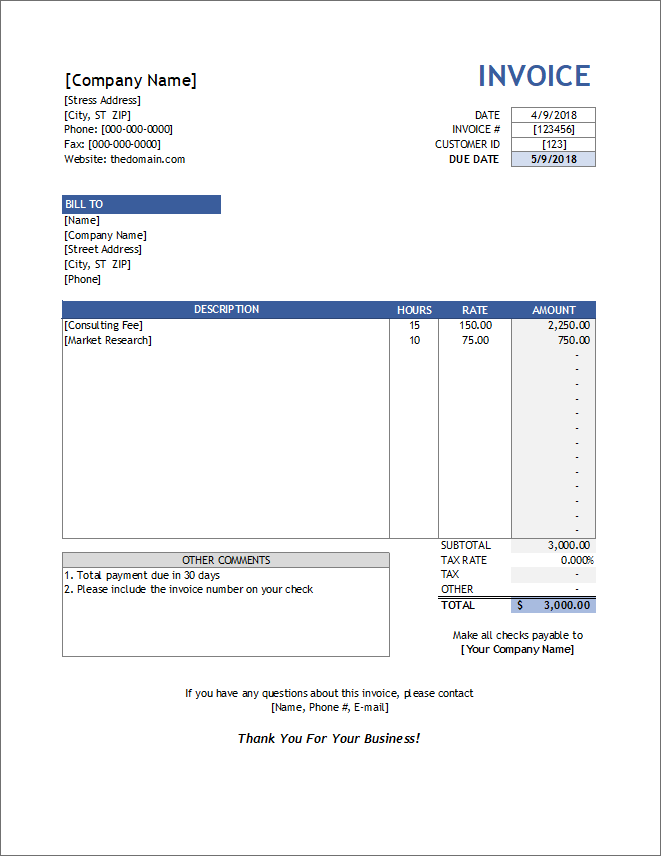

Service Invoice Template For Consultants And Service Providers

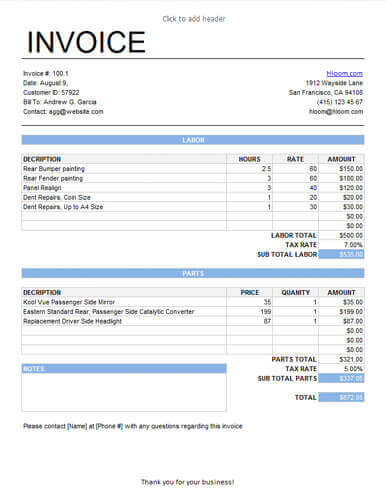

25 Free Service Invoice Templates Billing In Word And Excel

Service Invoice Template For Consultants And Service Providers

Service Invoice Template For Consultants And Service Providers

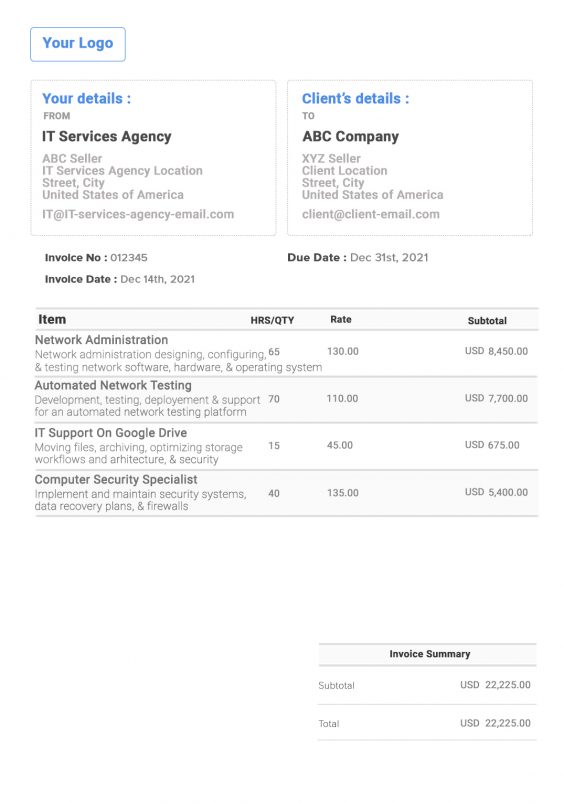

It Services Invoice Template Free Invoice Generator

25 Free Service Invoice Templates Billing In Word And Excel

Service Invoice Template For Consultants And Service Providers